“Is it possible to invest money while in college?”

–Carlos Souza

The majority of college students start their first months in the job market with low amounts of cash, no savings, and credit card debt. Even after graduation most of us still don’t have any reserve of cash, especially during recession periods it becomes harder. But there are a couple of good options to start saving and investing our money while we still are in college. First of all there are a couple of important questions you should ask yourself before you start to invest, such as why am I investing? What is the end goal? A car, a house, my retirement, or just a reserve for rainy days? For how long should I invest? How much will I need to reach my goal? Most of these are personal questions and the answers vary largely on your goal. A second important step is considering three determining factors: Liquidity (refers to the accessibility of your money and how easily it’s converted to cash); Safety (refers to the risk involved); and Return (how much you can expect to get back from your initial investment). Keep in mind the only way to get a higher average return is to lower your safety. After these steps, it is time to look at the different investing options:

• Stocks: when buying stocks, you buy a piece of a company. When a company is doing well, you may receive some of their profits through dividends (which are typically paid quarterly), and the price per share will also increase. Unfortunately, this works both ways and the loss can be great, too.

• Bonds work as loans you make to the government or corporations, are another, often safer, option. Bonds usually pay a specific amount or interest rate (around 5-7 percent) on a regular basis

• Mutual Funds offer simplicity, variety and built-in diversification that is appealing to many investors.

• Saving Accounts are a great option for students looking for flexibility in their investments is opening a savings account. Basic savings accounts don’t require a large initial investment. In fact, they work similar to checking accounts, but there are some limitations on how many times you can withdraw your money per month, but offer returns rates between 0.1% and 0.6%.

• Money market accounts This type of account works just like a savings account, but it requires a larger initial investment, so this kind of investment is harder for college students, but if you have a good quantity of money it can be a good option because they offer a good return and are safe.

• Retirement Plans plan like the 401(k) allows a worker to save for retirement and have the savings invested while deferring current income taxes on the saved money and earnings until withdrawal. The employee elects to have a portion of his or her wages paid directly, or “deferred,” into his or her 401(k) account Now you just should decide the best option for yourself and start to invest, you can do it through financial advisors, stock brokers, fund managers, bank, as well as transactions via the Internet. For more information contact one of your SIFE team members.

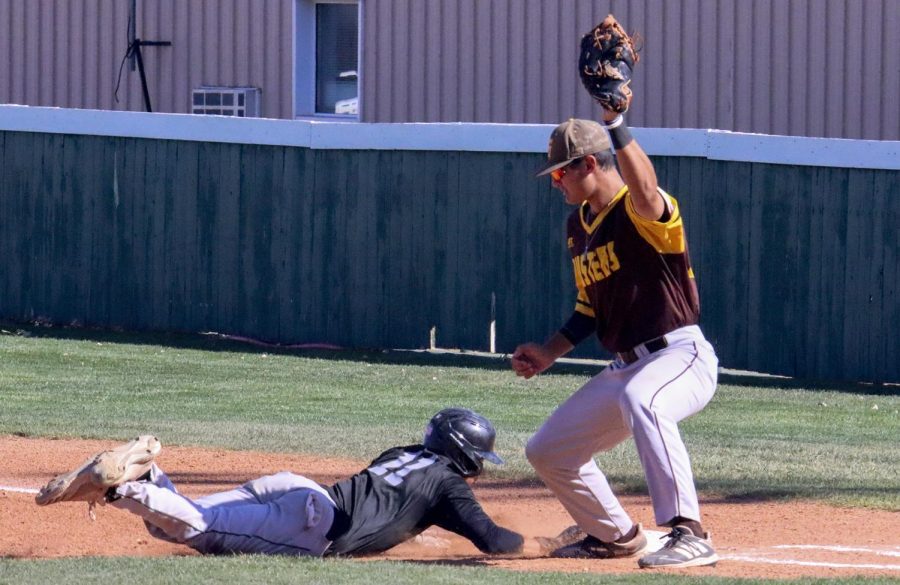

![The sophomores were recognized on the field instead of walking across the stage during their doubleheader. They received their diplomas and a picture of themselves playing during their career at Seward. [Pictured left to right are Dylan Day, Reed Thomas, Jase Schneider, Mason Martinez, Gannon Hardin, Brody Boisvert, and Zach Walker]](https://crusadernews.com/wp-content/uploads/2022/05/WEBDSC_0275-900x454.jpg)