TURN IN YOUR FAFSA! Are you nervous and don’t know what to do? DON’T BE!

TURN IN YOUR FAFSA! Are you nervous and don’t know what to do? DON’T BE!

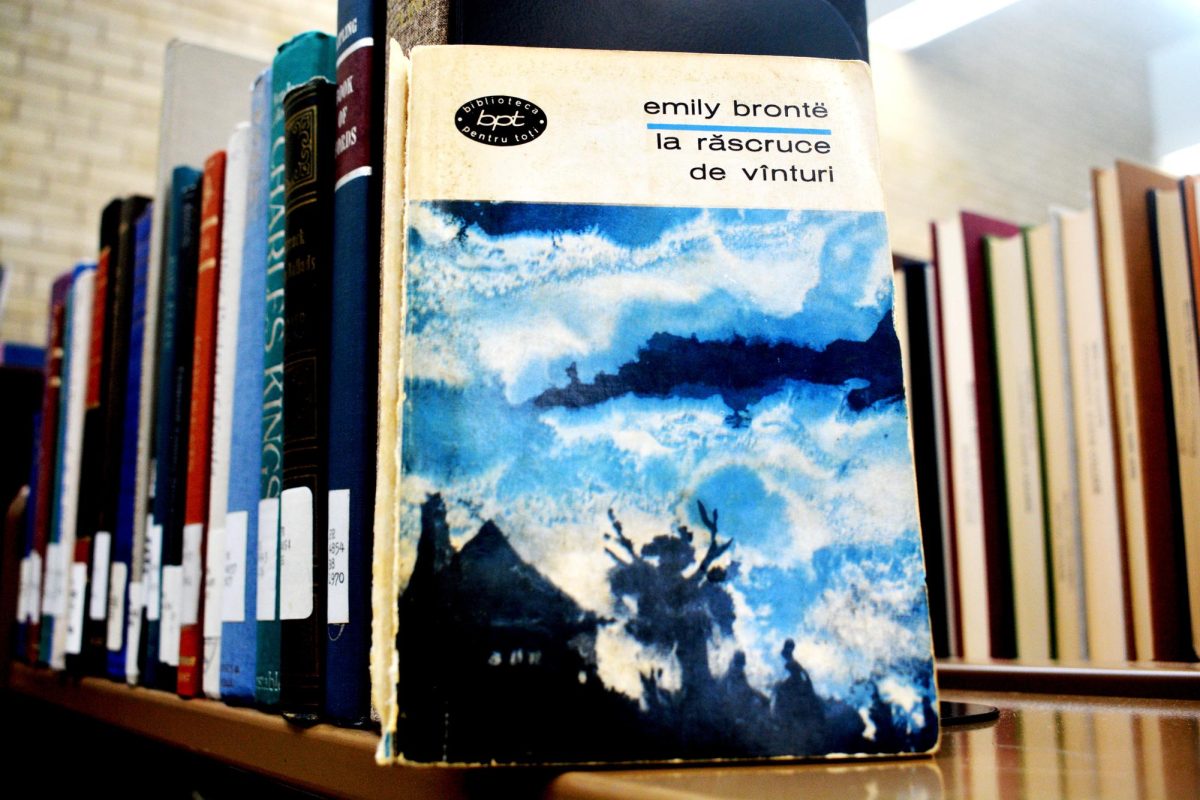

First of all, what is FAFSA? How would it help? FAFSA stands for Free Application for Federal Student Aid. An online form is filled out to determine if one qualifies for financial aid. The aid FAFSA can provide comes in the form of grants, work-study opportunities and loans. FAFSA considers a family’s income, assets and other factors to determine how much aid one may be eligible to receive. It’s an important step in the college application process for many students because it can help make college more affordable.

In the State of Kansas, the deadline for the Financial Aid Form 2024-2025 is April 1st.

Be Prepared!

Before filling out the form, one needs a verified account username and password, as in a FSA ID. The FSA ID is used to log into the FAFSA account. It’s important to keep this information secure and private. Provide the name, date of birth, Social Security number, and email address of the parent or spouse who will be contributing information for the FAFSA. If required, one will need to provide details about their income and assets. The tax form needed would be from the year 2022 for this year’s FAFSA form. This helps determine eligibility for financial aid.

There are resources everywhere!

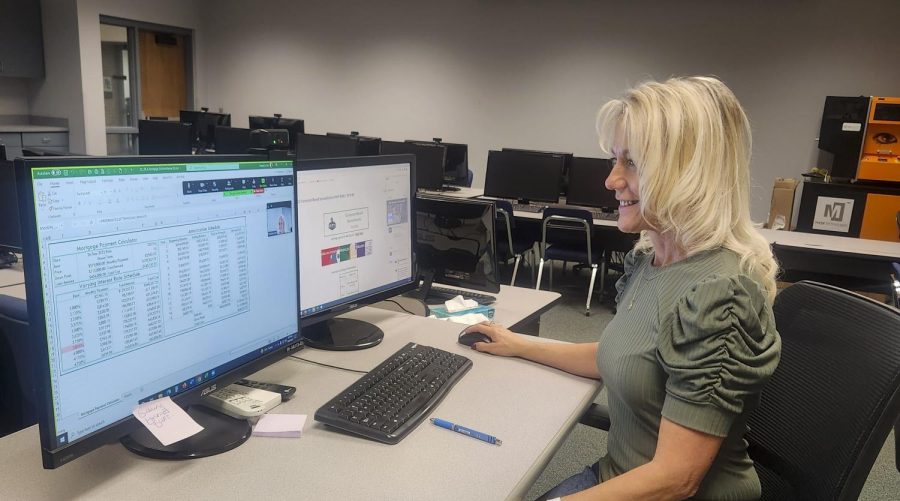

Colleges such as Seward County Community College provide the resources for students to complete FAFSA. For example, SCCC hosted a FAFSA Round-Up on Feb. 24 where the Financial Aid department helped students and parents complete the FAFSA form with a detailed presentation and step-by-step process.

Alma Avalos

Scholarship Coordinator in Financial Aid

What are the changes in this year’s form of FAFSA?

“One of the biggest changes for the FAFSA was that it opened in December…instead of the usual opening that is Oct. 1ts.

Another big thing that happened is that… a lot of the vocabulary has been changing from what we’ve previously known. For example, instead of having an EFC, which is the estimated family contribution (that’s the number that gets generated whenever you put all that tax information in there), now it’s going to be called an SAI, which is the student aid index. So now that number before the EFC, the lowest it could go was a zero, and if that was a zero, it basically says that that student is “Full Pell.” Now with this changing, the lowest the number can go is down to negative 1,500. Parents without socials have not been able to create FSA IDs prior to this new…update that they did. Now parents that don’t have social security numbers are going to be able to help their students finish their application online instead of having to print off a signature like previous years.

The process is simpler than previous years but there’s been different family situations or parents without socials that we haven’t been able to help students as much as we could just because it’s part of the department of education and not so much on our end, its just those little things that they still have to fix.”

How does it benefit students?

“So FAFSA in general benefits the students because…we’re able to see whether…students through FAFSA can qualify for Federal Pell Grant, which is money that they won’t have to pay back and that’s…based off of that number that gets generated. Also we’re able to see if they’re eligible for loans and while a lot of students don’t want to take out a loan because they have to pay that back, we usually have them look into loans…if that’s the only thing they’re eligible for because the interest rate is going to be much smaller then if they go to a private loan like through a bank.

Currently, our interest rate for loans is 5.5% whereas sometimes for a bank if you go get a loan it’s going to be depending on your credit…another option is that we can see if their eligible for work-study, where is that they can find a job on campus…where they can make a little extra money to help out during school and the good thing about work-study is that it is flexible.”

Jackie Cortes

Major: Nursing

What has been your experience when filling out FASFA?

“It was very easy because I had my sister who went to college, and she was very helpful.”

How does FAFSA benefit you personally?

“It helps pay for my college. The little bit of help I did get.”

After completing the FAFSA, do you know what to do next?

“I get an email saying how much I get. Usually, it goes to the college and processes it there.”

Naomi Macias

Major: Nursing

What has been your experience when filling out FASFA?

“It sort of felt like it was a waste of time because I didn’t qualify for anything but a loan, and I didn’t take the loan. So, it really didn’t affect me in any way.”

How does FAFSA benefit you personally?

“It didn’t benefit me because I didn’t qualify for no grants, like scholarships, anything like that. Just one loan that was like $5,000, and I didn’t take it.”

After completing the FAFSA, do you know what to do next?

“Yeah, I had to wait then I had to check back on it and see what I qualified for.”

For more information on how to apply for FAFSA visit to the following website https://studentaid.gov/h/apply-for-aid/fafsa

![The sophomores were recognized on the field instead of walking across the stage during their doubleheader. They received their diplomas and a picture of themselves playing during their career at Seward. [Pictured left to right are Dylan Day, Reed Thomas, Jase Schneider, Mason Martinez, Gannon Hardin, Brody Boisvert, and Zach Walker]](https://crusadernews.com/wp-content/uploads/2022/05/WEBDSC_0275-900x454.jpg)