Do you know why a budget is so important? For most people it seems that creating a budget is just a tedious financial exercise, especially if you feel your finances are already in good order. But you might be surprised at just how valuable a budget can be. A good budget can help keep your spending on track and even uncover some hidden cash flow problems that might happen if left unnoticed. It also can help you to invest your money correctly in order to achieve your financial goals. Budgeting lies at the foundation of every financial plan. A budget is nothing more than a breakdown or plan of how much money you have coming in and where it goes. It is useful for large corporations and for common workers as well. It doesn’t matter if you’re living paycheck-to-paycheck or earning a lot of money a year. A budget includes a list of all planned expenses and revenues. The hardest part of creating a budget is sitting down to start it. But after you realize how easy it is and that it takes just few minutes per week, budgeting tends to become an easy routine. Creating a budget generally requires four steps. The first step is to identify how you are spending money now. The best way to do that is by listing your expenses, dividing them into categories to help you to know exactly where your money is going. Second, evaluate your current spending and revenues to set goals that take into account your long-term financial objectives. At this moment you have to match your fixed expenses with your revenues. By doing that you can know how much you spend unnecessarily and will be able to direct this money to your financial goals. Third, track your spending to make sure it stays within those guidelines. This is the moment that you have to be disciplined to spend just on what was planned previously and obviously in situations that you could not foresee. Last, keep it up to date. Budgeting is a constant exercise, so push yourself to do it weekly, biweekly, or monthly depending of your needs. Budgeting definitely is the first step to keeping a healthy financial situation. Following the steps above, you will be able to start to budget and hopefully achieve your financial goals. If you want to study more about this subject you could take classes of microeconomics, personal finance, and managerial accounting.

Budgeting: keeping your spending on track

April 30, 2010

More to Discover

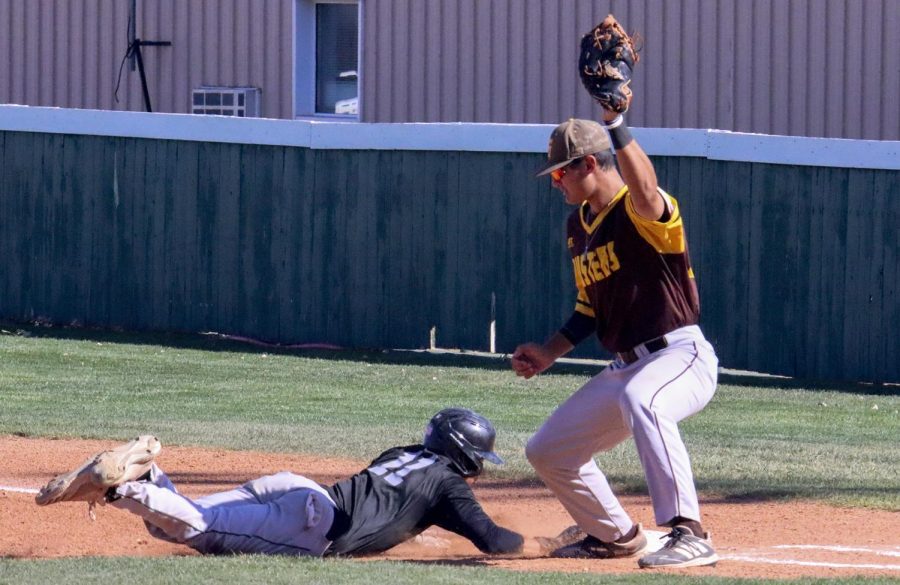

![The sophomores were recognized on the field instead of walking across the stage during their doubleheader. They received their diplomas and a picture of themselves playing during their career at Seward. [Pictured left to right are Dylan Day, Reed Thomas, Jase Schneider, Mason Martinez, Gannon Hardin, Brody Boisvert, and Zach Walker]](https://crusadernews.com/wp-content/uploads/2022/05/WEBDSC_0275-900x454.jpg)